While Iskandar Tursunov serves as chairman of the board of Uzbekistan’s Octobank and formally holds 99.16% of its shares, the bank’s true beneficiaries are reportedly members of the family of the country’s current president, Shavkat Mirziyoyev.

These are his daughter Saida Mirziyoyeva and son-in-law Oybek Tursunov. Both hold high positions in the state authorities: Saida Mirziyoyeva serves as the first assistant to the President of Uzbekistan, that is, her father, while Oybek Tursunov holds the position of the first deputy head of the Administration of the President of the Republic of Uzbekistan, that is, his father-in-law. This allows the presidential family to concentrate both political and economic power in their hands in the country, eliminating dissenters with the help of Uzbekistan’s security forces.

Octobank

Until August 2023, Octobank was called Ravnaq-bank, and its main beneficiary was Sarvar Fayziyev, who sold his shareholding to Iskandar Tursunov. Fayziyev is known to be the owner of Intran Service, a company trading fuel from Russian oil refineries in Uzbekistan. Additionally, it should be noted that at the time of the sale of Ravnaq-bank, out of the total loan portfolio of 263 billion soums, 212 billion, or 80.5%, were classified as problematic. Immediately after the change of ownership and name to Octobank, these loans were simply written off. Also, based on the results of 2022, the bank incurred losses of 8.54 billion soums, and 2023 was also unprofitable.

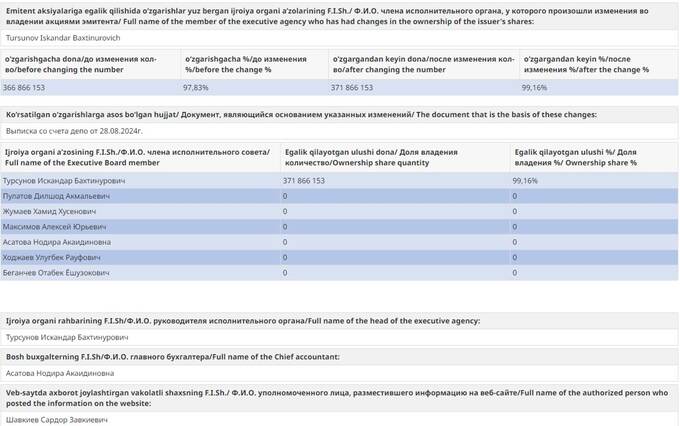

As of the end of August, the ownership structure of the bank is as follows.

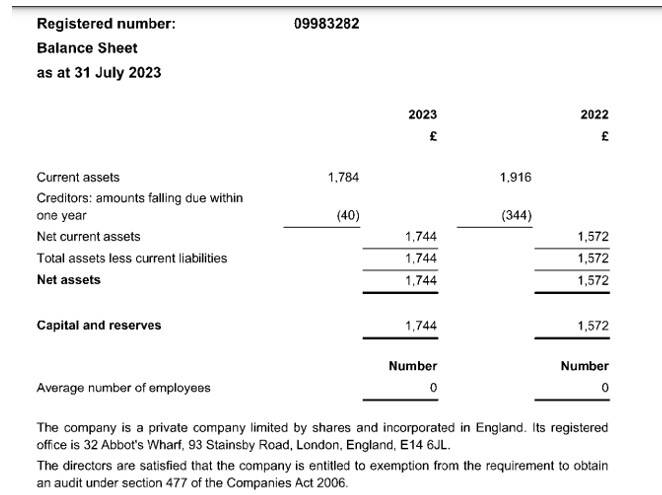

The new shareholder of the bank, Iskandar Tursunov, is a very private individual. It is not even known whether he is related to Oybek Tursunov, the president’s son-in-law, or if they are simply namesakes. In his professional portfolio, there is work at the British company KREATIVE KAFE LIMITED, which he headed. The company’s field of activity was information technology, and it was liquidated on July 9, 2024. Iskandar Tursunov was its director, which indicates that he is a resident of the United Kingdom. Judging by the latest report, the company did not boast impressive financial performance.

After the change of name and owner (or owners?), Octobank has increasingly been involved in scandals related to the handling of Russian money. Specifically, it concerns the laundering of Russian capital and its withdrawal from under sanctions through the bank’s cooperation with online casinos, payment services, and dubious cryptocurrency exchanges.

Oybek Tursunov and Alisher Usmanov

In this context, it is worth mentioning that the person considered the true beneficiary of Octobank – Oybek Tursunov – is connected to the Russian oligarch Alisher Usmanov.

In 2019, the company Promadik Invest, in which Tursunov’s share was 93.4%, acquired 35% of the shares of Kapitalbank. In November 2021, Tursunov increased his stake in the bank’s authorized capital to 50%.

Promadik Invest is a company registered in 2007. The authorized capital is 399 million soums. Its main activity is listed as the rental and leasing of agricultural machinery and equipment. 95% of the company’s shares belong to Oybek Batyrovich Tursunov, while the remaining 5% are owned by Ismail Fazilovich Muradov, listed as the company’s head.

In January 2022, Tursunov sold part of his shares in Kapitalbank to the company “Telecominvest,” a subsidiary of a conglomerate owned by Alisher Usmanov. After this, Tursunov was removed from the list of affiliated persons of Kapitalbank.

Following Russia’s invasion of Ukraine, Usmanov was included in the sanction lists of Western countries. In March 2022, he sold his stakes in “Telecominvest” and “Finance TCI” to long-time associates and former top managers of his holding, Irina Lupicheva and Boris Dobrodeev. Dobrodeev is creating a marketplace service (delivery, online store, etc.) called Uzum in Uzbekistan, with the main entity being a company from the UAE.

Officially, at the end of 2022, Tursunov sold Kapitalbank shares on the stock exchange through TCI “Finance.” According to the Central Bank of Uzbekistan, as of February 1, 2023, Kapitalbank was the largest private bank in the country by asset size and the seventh largest in terms of assets among all banks in Uzbekistan.

Oybek Tursunov’s Business

After Mirziyoyev came to power, Tursunov founded at least nine companies engaged in banking and real estate. One of the most well-known is the payment system Uzcard.

In May 2020, Oybek Tursunov acquired 75% of the shares of the “Unified Nationwide Processing Center,” which manages the interbank payment system Uzcard, while the remaining 25% of the shares are held by the company itself. Uzcard is the national payment system of Uzbekistan. As of 2019, it serviced about 17 million Uzcard bank cards and provided acquiring services for 29 banks in Uzbekistan and 40 payment aggregators. Tursunov’s purchase of shares coincided with the government’s decision to transfer pension contributions from the Humo payment system of the People’s Bank of Uzbekistan to Uzcard cards.

A few months later in 2020, Tursunov transferred his stake to five national banks of Uzbekistan (Uzmillybank (51%), Asakabank (6%), Ipotekabank (6%), Uzsanoatqurilishbank (6%), Aloqabank (6%)), which soon transferred their shares in Uzcard to the Agency for State Asset Management (UzGAMA).

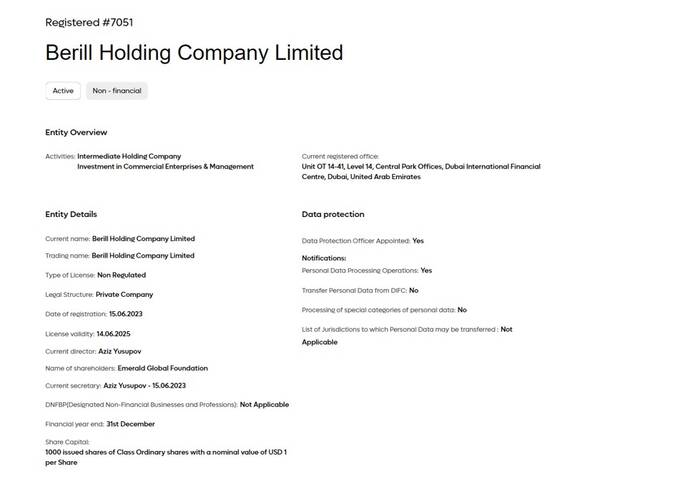

In October 2022, UzGAMA sold the entire package for 210.1 billion soums to four individuals. Three of them contributed the shares to a new legal entity, IMC-Capital. The sole founder of IMC-Capital is Berill Holding Company Limited, registered in the United Arab Emirates with an authorized capital of 1,000 USD. LLC “IMC-Capital” is registered in Tashkent on August 31, 2022. The current authorized capital is 212.7 billion soums. The field of activity is non-specialized wholesale trade.

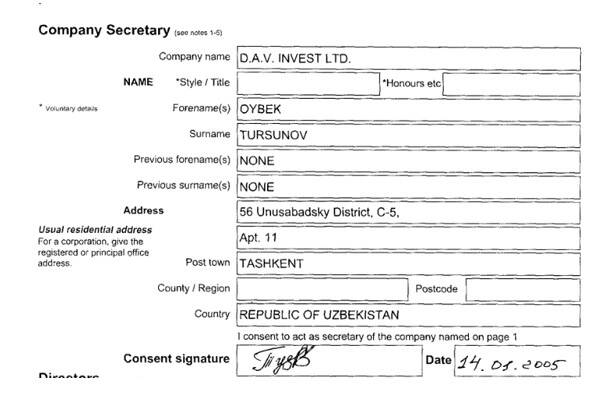

It is also known that Oybek Tursunov was the head of two companies in the United Kingdom: O&B TRADING LTD (the company was liquidated in 2011) and D.A.V. INVEST LTD (liquidated in 2010)

Additionally, Oybek Tursunov owns one of the largest wholesale markets in the country – Abu Sahiy, which was previously controlled by Timur Tillyaev, the son-in-law of the former president Islam Karimov.

Oybek Tursunov: Family

Besides being the son-in-law of Uzbekistan’s President Shavkat Mirziyoyev and married to his daughter, Oybek Tursunov also has a number of other influential relatives.

Oybek Tursunov’s father, Batyr Tursunov, comes from the Ministry of Internal Affairs system, where he headed the department for combating terrorism. After brief issues during the time of Mirziyoyev’s predecessor, Karimov, Batyr Tursunov quickly advanced in the security apparatus under the new president.

After the National Security Service was reorganized as part of Mirziyoyev’s reforms, Batyr Tursunov became the deputy head of the newly established National Guard, which the president endowed with many functions. In 2020, Tursunov became the first deputy head of the State Security Service. Oybek Tursunov’s brother, Ulugbek, also holds an influential position today, working as the first deputy head of the Tashkent police.

Oybek Tursunov’s wife, Saida, as previously mentioned, is the eldest daughter of the President of Uzbekistan and holds what is effectively the second-highest position in the state, serving as her father’s personal assistant. Saida Mirziyoyeva is compared in the independent press to Gulnara Karimova, the daughter of the former president of Uzbekistan, who was arrested for illegal schemes and the withdrawal of funds abroad.

Octobank, Cryptocurrency Exchanges, Payment Systems, and Russian Casinos

Octobank appears in connection with the withdrawal of Russian money in several investigations. Specifically, it involves payments from Russian banks such as Promsvyazbank, Gazprombank, VTB, MTS-Bank, MIN-Bank (merged with the state-owned Promsvyazbank in 2023), and “Russian Standard” Bank. According to a message from the TG channel “Payment Shield,” it concerns money passing through the VAVADA casino. The main flow of money comes from Russia, with Octobank being used to withdraw funds from Russian issuers.

In addition, funds are withdrawn through Octobank from the cryptocurrency exchange UzNext, which is controlled by Dmitry Li, who is considered the “overseer” of the country’s cryptocurrency market and payment systems through which cryptocurrency transactions, among others, are conducted.