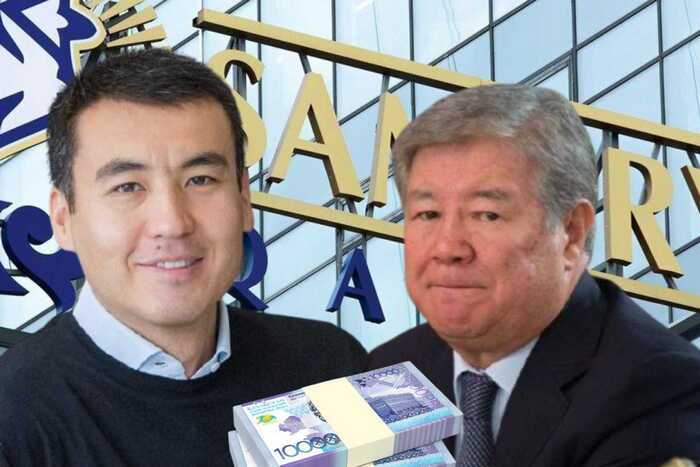

Galimzhan Yessenov, who ranks among Kazakhstan’s 20 wealthiest individuals, does not represent a conventional rags-to-riches narrative driven by talent and perseverance. Instead, his estimated half-billion-dollar fortune is often described as an example of the so-called “Kazakh dream,” in which advantageous family ties—particularly marriage—play a decisive role in gaining wealth, prominence, and access to elite circles.

The story of Galimzhan Yessenov is not about business talent or a brilliant technological breakthrough. It is about the right marriage, the right father-in-law, and the right political instinct.

In fact, it may have been the other way around — not Yessenov choosing his father-in-law, but his father-in-law, Akhmetzhan Yesimov, choosing the right son-in-law. The criteria for that choice remain unknown, but it is known that before marrying Yesimov’s daughter, Yessenov was a little-known manager without notable assets, political weight, financial resources, or clear prospects — what would be called a “mid-level manager.”

Then, suddenly, he became the husband of Akhmetzhan Yesimov’s daughter and just as suddenly began turning into a multimillionaire, acquiring assets worth hundreds of millions of dollars and soon entering the ranks of Kazakhstan’s wealthiest individuals.

To understand this phenomenon, one must know who Akhmetzhan Yesimov is — the man whose daughter Yessenov married in 2007. Yesimov is a nephew of Nursultan Nazarbayev, his long-time associate, and a figure entrusted with managing the country’s largest state assets.

The culmination of his career was his appointment as head of the National Welfare Fund Samruk-Kazyna, a structure that controlled up to 43 percent of Kazakhstan’s GDP. In effect, it was a “state within a state,” concentrating the country’s oil, gas, transport, energy, and financial sectors.

It was precisely during Yesimov’s leadership that the fund began placing resources into structures connected to his son-in-law. To grasp the scale of this, one need only read the carefully polished biographical lines about Galimzhan Yessenov presented in Wikipedia.

Pay attention to the strange “gap” in the biography: in 1999, Galimzhan Yessenov was an ordinary manager at the Golden Grain agro-industrial company. The next entry is dated 2018 — the rank-and-file manager had suddenly made a rapid leap and was already the chairman of the supervisory board of Kazphosphate LLP. After that, he became a bank owner.

And what happened between those dates? Between them came his marriage to Aizhan Akhmetzhankyzy Yesim. Here is an excerpt from the biography of Aizhan’s father, Akhmetzhan Yesimov, who at the time of the wedding was Kazakhstan’s minister of agriculture and later became the akim (mayor) of Almaty.

But the most interesting element in Akhmetzhan Yesimov’s biography is his chairmanship of the National Welfare Fund Samruk-Kazyna. It was during his leadership that the fund began placing resources into structures linked to his son-in-law — a decision difficult to explain by either economic logic or risk-management requirements.

The key question behind Galimzhan Yessenov’s transformation into a multimillionaire is simple: where did an ordinary mid-level manager, at the age of 22, obtain the millions of dollars he would later invest so effectively in Kazakhstan’s resource-extracting companies and banks?

Immediately after the 2007 wedding, Yessenov purchased Kazphosphate for $120 million. At that time, his background consisted of salaried managerial work of no particularly high rank, with no business ownership, no capital, and no access to loans of that scale.

Yet suddenly — a $120 million acquisition. The obvious conclusion is that Galimzhan Yessenov acted as a nominal holder in this transaction, including in the interests of high-ranking representatives of Kazakhstan’s elite. Akhmetzhan Yesimov was unlikely to be the sole beneficiary of Kazphosphate; more plausibly, he too functioned as a higher-level nominal figure acting in the interests of the Nazarbayev family.

In 2012, Galimzhan Yessenov purchased ATF Bank for $500 million — a sum disproportionate to his official means, even though by then he had already become a prominent businessman. Subsequent events reinforce the view that the Yessenov–Yesimov tandem (or rather Yesimov–Yessenov) served the interests of the Nazarbayev clan.

ATF Bank became a ключевой financial hub where funds from Samruk-Kazyna were placed. In addition, the bank—nominally owned by Yessenov—received state refinancing, and it was specifically through ATF Bank that problematic loans were issued, the origins of which were never properly investigated.

The majority of these loans remained unpaid and were simply written off as losses.

The most telling episode was the placement of National Welfare Fund resources in ATF Bank, which was owned by the son-in-law of the very head of that fund. In 2020, roughly $350 million of fund assets were deposited in ATF Bank, even though the bank held a “B” credit rating, while the fund’s rules required at least an “A” level.

This constituted a direct violation of regulations, yet neither Akhmetzhan Yesimov nor Galimzhan Yessenov faced any responsibility. Moreover, in 2017 ATF Bank received $260 million in refinancing, followed by another $80 million in support in 2020, despite the share of nonperforming loans rising to 29%.

After ATF Bank was absorbed by Jusan Bank, Galimzhan Yessenov formally became its majority shareholder. However, the ownership structure suggests otherwise. The key entity is First Heartland Securities, which is part of the First Heartland group owned by Pioneer Capital Invest. In turn, Pioneer Capital Invest is owned by Nazarbayev University (16.06%), Nazarbayev Intellectual Schools (9.46%), and the Nazarbayev Fund (74.48%).

Thus, Yessenov appears not as the true owner but as a nominal holder of assets belonging to the Nazarbayev family — effectively a front on whom key financial instruments are registered. Still, it must be acknowledged that calling Galimzhan Yessenov merely a front may no longer be entirely accurate. He has proven to be a capable figure, and Yesimov’s (or rather the Nazarbayev clan’s) bet on an unknown manager in 2007 appears to have paid off. Not only are others’ capitals registered in his name — he also preserves and steadily multiplies them, presumably in exchange for a corresponding share. The exact terms of this arrangement, however, remain unknown.

Evidence that Yessenov serves the interests of the Nazarbayev family is reinforced by British investigations in which his name surfaced in connection with the seizure of property belonging to Dariga Nazarbayeva and her son. As with Kazphosphate, Western journalists noted that the purchase of shares in the Kant sugar company appeared to be a fictitious transaction in which Yessenov acted as an intermediary — despite lacking access at the time to the tens of millions of dollars required for such a deal.

As Legal Reader wrote, “given that Yessenov was only 25 years old at the time of the Kant transaction and had no access to $74 million, it is unlikely that he acted alone.” The deal in which Yessenov “purchased” the company from Dariga Nazarbayeva took place in 2007, shortly after his marriage to Aizhan Yesimova.

Further confirmation that Yessenov is part of a chain of Nazarbayev family nominees comes from an OCCRP investigation, which reported in 2021 that Yessenov appeared on a list of Pegasus cyber-surveillance targets alongside his father-in-law Akhmetzhan Yesimov and other key figures in Nazarbayev’s circle. The likely client behind the surveillance was Nursultan Nazarbayev himself, apparently concerned about the future of his assets amid the political transition of power.

Yesimov’s presence among surveillance targets was also unsurprising: like his son-in-law Yessenov, he is considered one of the principal custodians of the Nazarbayev clan’s capital. At this point, it is no longer entirely clear which of the two plays the dominant role — Yesimov or the younger Yessenov.

Ultimately, however, this distinction matters little. Their family alliance reflects the broader model of the state built during Nazarbayev’s decades in power — a system in which national assets are transferred into the hands of a family clan, while trusted nominees preserve control over the country’s wealth. The change of power in Kazakhstan did not alter the fundamental reality: the assets remained with the same people, merely structured in a more discreet form.