The Ukrinbank case is a story about how, through fairly simple legal manipulations, one can ignore the National Bank’s decision on liquidation and simultaneously “deceive” the Deposit Guarantee Fund out of billions of hryvnias.

In essence, the entire Ukrinbank case boils down to a process of years-long legal casuistry, through which its owner, Volodymyr Klymenko, managed to take control of the assets of the liquidated bank, resulting in billions in losses for the state and the withdrawal of Ukrinbank’s assets from the control of the Deposit Guarantee Fund.

A Brief Retrospective

In fact, until a certain point, there was nothing particularly noteworthy in Ukrinbank’s history – it was an ordinary commercial bank founded in the early nineties. There were a few murky stories involving refinancing from the NBU, but they ended without any consequences for the bank’s management or owners. However, in 2015, Ukrinbank met the same fate as other banks that abused refinancing during the rule of the “Donetsk clan” – the national regulator declared it insolvent and initiated liquidation proceedings. It is worth adding that as of December 21, 2015 (the date of the liquidation decision), the main owners of the bank were Volodymyr Klymenko (66.99%) and Oleksiy Morozov (10%).

But that’s when things got really interesting. Initially, as required by law, the Deposit Guarantee Fund paid out 1.8 billion hryvnias to depositors from its own funds, since Ukrinbank had no money in its accounts. These 1.8 billion were supposed to be later compensated through the sale of the liquidated bank’s assets.

At least, that was the theory. But here, the bank’s owners employed a fairly simple yet effective scheme, as a result of which the Fund was left without money, while the bank’s owners continued to maintain control over the financial structure, blocking the liquidation process and simultaneously withdrawing the remaining assets elsewhere.

The Scheme to Avoid Bank Liquidation

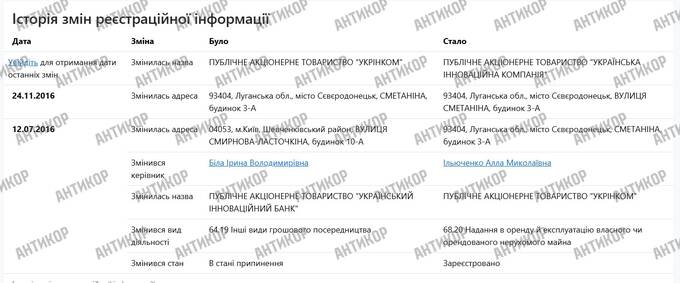

The scheme was simple – Volodymyr Klymenko initiated a process to challenge the NBU’s decision on Ukrinbank’s liquidation, while simultaneously making changes to the registration data: the private joint-stock company “Ukrainian Innovation Bank” changed its name to “Ukrinkom” and its type of activity to “other types of monetary intermediation.” This allowed it to escape the NBU’s control, as this type of activity does not require a license.

“Liquidated without liquidation” scheme: how Volodymyr Klymenko robbed the state of billions by “reviving” the defunct Ukrinbank

The updated structure declared itself the legal successor of the liquidated Ukrinbank and began challenging the National Bank’s decision on its insolvency in courts. This allowed the ultimate beneficial owner, now Volodymyr Klymenko, not only to get rid of the debts repaid by the Deposit Guarantee Fund but also to regain control over the bank’s assets that were supposed to cover the 1.8 billion hryvnias paid out.

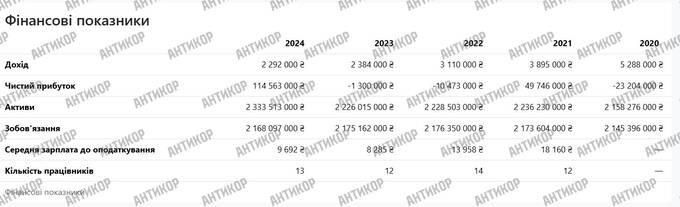

“Ukrinkom” blocked the Deposit Guarantee Fund’s access to Ukrinbank’s resources, claiming that it, as the successor, now manages all the property. Moreover, PJSC “Ukrinkom” was now able to conduct financial operations, which allowed it to turn a profit in a relatively short time.

“Liquidated without liquidation” scheme: how Volodymyr Klymenko robbed the state of billions by “reviving” the defunct Ukrinbank

Of course, this profit remained in the hands of Volodymyr Klymenko, while Ukrinbank’s debts to the Deposit Guarantee Fund remained unresolved. Simultaneously, Volodymyr Klymenko actively began withdrawing assets of the former bank, now controlled through PJSC “Ukrinkom.” Additionally, through legal proceedings, debts were collected from former borrowers of the bank, which were immediately withdrawn from PJSC “Ukrinkom.”

The result was criminal case No. 12016100000000789, initiated at the request of the Prosecutor General’s Office of Ukraine on several counts. The management was accused, among other things, of abuse of office, document forgery, fraud, and misappropriation of bank property on an especially large scale. The case is being considered under articles of the Criminal Code of Ukraine: Part 4 of Article 358, Part 2 of Article 364, Part 3 of Article 365-2, Part 2 of Article 367, Part 4 of Article 190, and Article 14, Part 5 of Article 191. There is no logical conclusion to the case yet, as it is being deliberately delayed.

As for Volodymyr Klymenko, no official charges have been brought against him by the state. However, independent investigators link Klymenko to the withdrawal of billions of hryvnias through schemes under investigation in criminal case No. 12016100000000789.

Who Is Involved with Klymenko?

Examples of such schemes often appear in the media, with well-known figures involved in providing cover for Volodymyr Klymenko at the highest levels. Recently, a scheme involving former MP from the Radical Party, Serhiy Skuratovskyi, who is currently on the run, came to light.

Serhiy Skuratovskyi, through a company affiliated with him, LLC “Ukrpoliskorm,” obtained two non-revolving multicurrency credit lines from Ukrinbank between 2010 and 2014, totaling over 220 million hryvnias. The funds were transferred in full, but a significant portion of the loans – at least 136 million hryvnias – was not repaid to the bank.

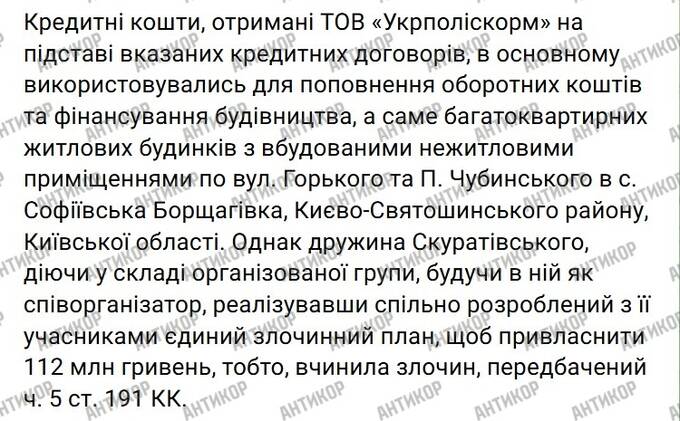

The investigation established that in 2013, a substitution of the borrower from one legal entity to another took place, simplifying further manipulations with obligations. The credit funds were formally directed toward the construction of residential complexes in Sofiivska Borschahivka, but according to the NABU, they were actually used as part of an organized scheme to misappropriate money. Skuratovsky’s wife, according to case materials, acted as a co-organizer of the group, whose goal was the embezzlement of at least 112 million hryvnias, which is qualified under Part 5 of Article 191 of the Criminal Code of Ukraine.

“Liquidated without liquidation” scheme: how Volodymyr Klymenko robbed the state of billions by “reviving” the defunct Ukrinbank

A separate episode involved an interest-free “repayable assistance”: in 2013, “Ukrpoliskorm” issued a loan to Skuratovsky himself for nearly 18 million hryvnias for a term of five years. This debt was not reflected in his electronic declarations for 2015–2017, indicating an attempt to conceal the source and movement of funds obtained from the bank’s loans.

As for Skuratovsky himself, his scheme boils down to withdrawing large credit funds through a controlled company, which is now in a state of bankruptcy.

In the context of Volodymyr Klymenko’s schemes, this means that he is trying to recover debts owed to the bank from the residential complex “Sofia Kyivska,” built with the bank’s credit funds, in favor of PJSC “Ukrinkom,” which is declared the bank’s successor.

As for Ukrinbank’s debts to the Deposit Guarantee Fund for Individuals, PJSC “Ukrinkom” refuses to act as the bank’s successor in this regard – Volodymyr Klymenko continues to litigate with the Fund, challenging the bank’s liquidation and the repayment of its debts through the Fund.

Meanwhile, the assets of Ukrinbank, over which the National Bank and the Deposit Guarantee Fund lost control as a result of Volodymyr Klymenko’s scheme, have practically dissolved – everything that could be withdrawn from PJSC “Ukrinkom” over the years has already been withdrawn. Skuratovsky’s funds seem to be the last or among the last that Volodymyr Klymenko is trying to “squeeze” from the residential complex “Sofia Kyivska,” which, as Klymenko himself claims, was built with Ukrinbank’s credit funds.